Most commodities are traded on wholesale markets. Typically, smaller end-users (like residential customers) don’t participate directly in those markets but rather buy those things from a retailer. What happens in wholesale markets does impact the prices end-users pay, but it’s often quite complicated and different wholesale markets are subject to different rules.

Many other provinces in Canada do not use a market-based system to set wholesale electricity prices, but electricity markets are common in many parts of the world and across North America. Alberta has had a wholesale electricity market for about 25 years, but there is still some disagreement over how it should work or whether a non-market system would be better.

Interested in how the Alberta wholesale price of electricity is set, what influences it and how that impacts the final price you pay each month? If the answer is yes…read on.

Alberta’s Wholesale Market Explained

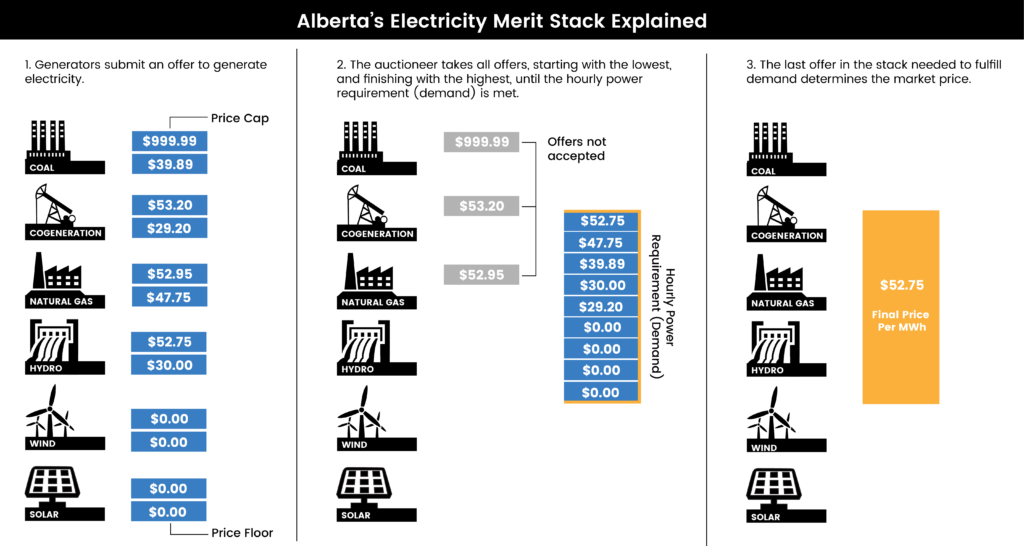

Wholesale market prices are determined in an auction with very specific rules. Generators above a certain size connected to the grid must submit an offer to produce electricity unless their facilities are unable to do so – these are the sellers in the auction. The market rules allow each generator to offer at a price greater than or equal to $0 (yes, you can offer to give it away for free – something wind and solar generators often do) and as high as $999.99 per megawatt-hour (MWh). Each generator determines how much energy they want to sell at each price (between $0 and $999.99). The auctioneer takes all the offers and orders them in a stack (sometimes referred to as the ‘Merit Stack’ or a ‘Merit Order’) from cheapest (at the bottom) to most expensive (at the top).

Typically, auctions feature lots of buyers who choose whether or not to buy at a given price. Not so in Alberta’s electricity market. Instead, the total electricity demand is compared against the stack of all of the generators’ offers (ordered from cheapest to most expensive). The last offer in the stack needed to fulfill demand determines the market price at that minute. That is potentially 525,600 different prices in a year (more in a leap year!).

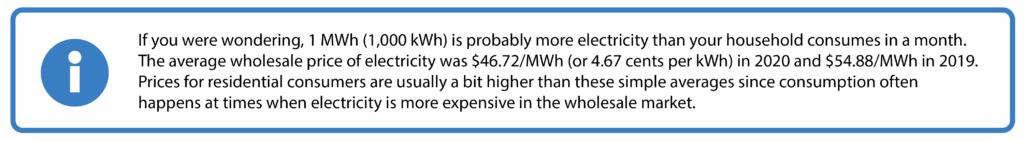

To simplify things a bit, final wholesale prices are based on an hourly average of the minute-by-minute prices for a more manageable 8,760 different prices for a year. Why does electricity have so many prices for such short periods of time? The answer is quite simple – it is still quite difficult to store large amounts of electricity, and without that storage to smooth out supply and demand, prices can vary considerably during a day.

Over the course of an hour, any generators that produced electricity receive the wholesale price for that hour (the average of the minute-by-minute prices) even if you offered at much lower prices. If you don’t produce any electricity, you don’t get paid anything.

Settling the Bill

Given those hourly prices, we need to work out who consumed what in a given hour in order to send out bills. Larger industrial customers have meters that record their consumption at least once per hour. That determines how much they pay for their energy from the auction. For smaller customers in Alberta, the retailer pays for the energy consumed by all of the customers they look after.

Smaller customers in Alberta typically have a meter that is read (or estimated) once a month. This information is combined with a load profile that describes when similar customers in your area are likely to have consumed electricity. That profile of consumption combined with the prices from the auction determines what your retailer pays. Electricity auction prices can be quite volatile, so most large customers and retailers choose to buy “hedges” (pre-purchased blocks of electricity at a set wholesale price) to reduce the risks due to volatility in the market. Some may also generate their own electricity, which acts very much like a built-in hedge.

As a small consumer, you have a choice of different products from different retailers. Some are fixed-price products for a year or more. These correspond to situations where the retailer is taking most of the risk of volatility for you. Some retailers also offer products that are more volatile. Depending on which retailer and which product you have chosen determines the rate you pay. If you don’t choose a retailer in Alberta, you receive retail service from a regulated provider who only offers one type of product (also known as the Regulated Rate Option, RRO). No matter which retailer you go with, what happens in the wholesale electricity market influences the prices retailers can offer for energy.

You may have noticed your electricity bill includes a lot more than energy charges. You will also see charges for transmission, distribution, municipal charges and other “riders.” While some of these charges vary with how much electricity you use, none of these are determined by the wholesale electricity market, nor can they be controlled by your retailer as they are regulated by the Alberta Utilities Commission (AUC) and charged by the Wires Service Provider (WSP) in your area. Oftentimes the regulated charges make up the majority of a consumer’s electricity invoice and will vary based on where in the province (which Wires Territory) you are located. This is another piece of Alberta’s electricity market that is complex and is best covered in its own blog in the future.

In our next blog in this series, we will examine how the auction works in more detail and why prices are sometimes higher than at other times. You might imagine that when electricity demand is high, prices might also be higher. Sometimes that is indeed the case, but not always!

You might also be wondering what happens if something doesn’t go exactly as planned and what sort of back-ups are built into the system to make sure your supply of electricity is reliable. If you are interested in finding out, let us know your questions, and we can provide the answers!

Let’s Get Technical -Understanding Electricity Jargon

You probably noticed that the wholesale electricity market is quite complicated. It is made more complicated still as there is a lot of jargon we have tried to avoid in the explanation above. If you want to understand more about the electricity market, understanding the jargon becomes important.

Prices in the Alberta market can’t be lower than $0, which is called the price floor. Many electricity markets even allow negative prices where consumers are paid to use electricity. Prices like these are rare and usually correspond to situations where it would be very expensive for generators to reduce production.

Prices in the Alberta market cannot be higher than $999.99/MWh, called the price cap. Many other electricity markets have even higher price caps than Alberta (in Texas, this was set at $9,000/MWh, but is currently under review); prices only reach these levels occasionally, and they provide strong incentives for larger customers (who are exposed directly to wholesale prices) to reduce consumption, and to generators to produce as much as they can.

The electricity grid refers to the interconnected network of wires that transport electricity from generators to consumers.

The wholesale auction for electricity in Alberta is sometimes called the Power Pool. The wholesale price determined each hour is called the Pool Price, and the price that is determined each minute is called the System Marginal Price (SMP). Alberta’s auction is a type called a uniform clearing price auction since everyone who produces energy receives the same price for what they generate no matter what they offered.

The wholesale auction in Alberta is administered by a government agency (the “auctioneer”) called the Alberta Electric System Operator (AESO). Because one acronym is never enough, it is also known as the Independent System Operator (ISO). The AESO collects the offers from different generators, orders them from cheapest to most expensive to create a ‘merit stack’ or ‘merit order’. The AESO determines the System Marginal Price by comparing the merit stack with the prevailing level of demand for electricity (this is sometimes called load). It’s also worth noting that supply can come from imports and that exports can increase demand.

The process of working out who receives payments from, or who is required to make payments to the wholesale market is called settlement. Given that there are a great many meters to read, it usually takes a few months before settlement calculations are finalized.

About the Author

Matt Ayres, Ph.D.

Matt loves explaining how electricity markets work! Matt currently works as a consultant and has over 20 years of experience working in a number of electricity markets, including the CEO and Chief Economist of Alberta’s electricity watchdog, the Market Surveillance Administrator. Matt is also an Executive Fellow at the School of Public Policy and an Adjunct Assistant Professor in the Department of Economics at the University of Calgary. Any views expressed are those of the author and not the views of any organization to which they are affiliated.

Contact: Matt Ayres (LinkedIn)